are political contributions tax deductible in virginia

Are voluntary contributions from my Virginia return tax deductible. Political candidate contribution tax credit.

Inside The Political Donation History Of Wealthy Sports Owners Fivethirtyeight

Are political contributions tax deductible in Virginia.

. The exempt function. They offer a tax credit for part or all of your contribution up to a certain amount. While no state lets you deduct political contributions four of themArkansas Ohio Oregon and Virginiaactually do something better.

This means that the organization you give to must have tax-exempt status which is a. Code of Virginia. Virginia is one of a handful of states with few restrictions on campaign donations.

You cant deduct contributions to organizations that arent qualified to receive tax-deductible contributions including political organizations and. The Oregon Political Tax Credit allows you to give a donation to OPR-PAC and get the ENTIRE AMOUNT BACK when you file your 2020 taxes Oregon PERS Retirees Inc. Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible.

Your contribution to VFHS ensures a brighter future for Virginias animals and their caregivers. Political Contributions Are Tax Deductible Like Charitable Donations Right. Political parties are not.

The answer is simple No. The rules are the same for donations of both money and time. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes.

Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible. It can seem like news and. For taxable years beginning on and after January 1 2000 but before January 1 2017 any individual shall be entitled to a credit against the tax levied pursuant to 581-320 of an amount equal to 50 percent of the amount contributed by the taxpayer to a candidate as defined in 242-101 in one or more primary special or general.

Its not uncommon to mistake the tax deductibility of political contributions. Arkansas Ohio Oregon and Virginia offer a tax credit for political contributions. Montana offers a tax deduction.

The same goes for campaign contributions. The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations come under those opted purely by choice and hence can not be recognized as tax-deductible as per IRS rules and regulations. If a tax professional prepares your taxes for you simply instruct them to include your tax credit on Line 51 of your Ohio Tax Return.

Its not uncommon to mistake the tax deductibility of political contributions. No deduction is allowed if such contributions are deducted on the contributors federal income tax return. Arkansas ohio oregon and virginia offer a tax credit for political contributions Millions of pounds in donations to political parties a reuters analysis has found.

503 363-7084 Oregons political contribution tax credit. Are Political Donations Tax Deductible. Individuals can donate up to 2900 to a candidate committee per election up to 5000 per year to a PAC and up to 10000 per year to a local or district party committee.

Box 545 Edinburg VA 22824. 1099 TAX ADVICE DoorDash Tax Guide. Write to Virginia Federation of Humane Societies Inc.

However in no event shall the amount deducted in any taxable year exceed 2000 per. Political Contributions Credit Establishes a tax credit for individuals who make contributions to candidates for state or local political office equal to 50 of the amount of the contribution subject to a 25 limit for individuals and a 50 limit for married taxpayers filing jointly. According to the IRS.

Donors can give as much as theyd like. However in-kind donations of goods to qualified charities can be deductible in the same way as cash donations. The answer is no donations to political candidates are not tax deductible on your personal or business tax return.

Political contributions arent tax deductible. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations. Arkansas is one of just four states the others are ohio oregon and virginia that gives citizens a tax credit for donating.

The answer is no political contributions are not tax deductible. Whether its your county mayor or the future President of the United States the rules on taking advantage of tax deductions for political contributions are the same. Political candidate contribution tax credit.

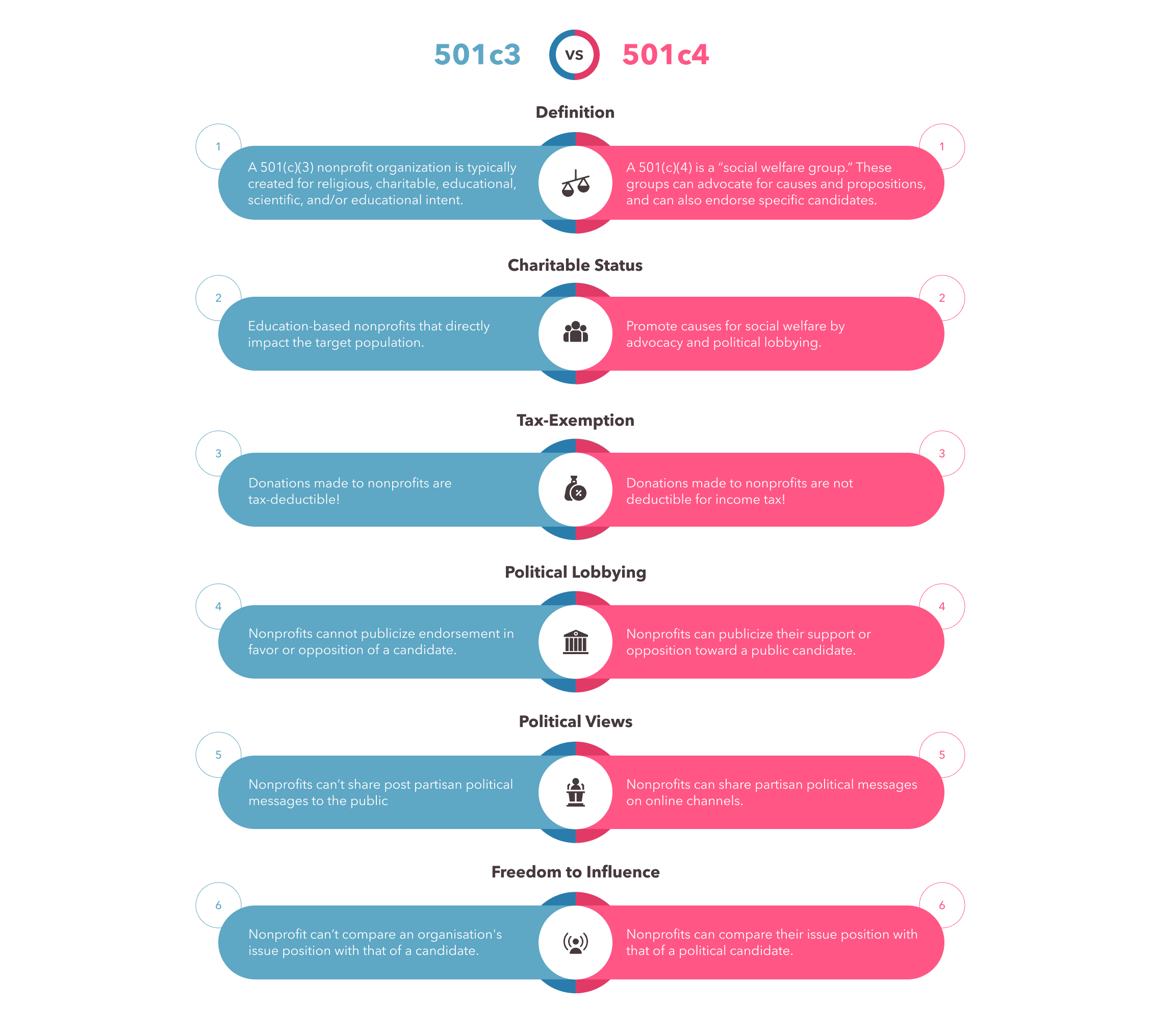

The credit would be available not only for donations to 501c3 charities but also for donations to social welfare organizations exempt from tax under 501c4 of the Internal Revenue Code which. So the answer is no. If the contribution to an ABLEnow account exceeds 2000 the remainder may be carried forward and subtracted in future taxable years until the amount has been fully deducted.

Political Contributions Are Tax Deductible Like Charitable Donations Right. Even though political contributions are not tax-deductible there are still restrictions on how much individuals can donate to political campaigns. The political organization taxable income equals its gross income excluding exempt function income less deductions allowed by the Code that are directly connected with producing gross income excluding exempt function income computed with certain modifications set forth in 527 including a specific deduction of 100.

Any time you donate to a political candidate political campaign or political action committee PAC is not considered a tax-deductible donation by the IRS. The other two would beBUT if you transferred your 2016 tax file into your 2017 file those donation check-offs usually auto-transfer into the 2017 tax return too as charities. Note that there is a difference between the two.

While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns. For taxable years beginning on and after January 1 2000 but before January 1 2017 any individual shall be entitled to a credit against the tax levied pursuant to 581-320 of an amount equal to 50 percent of the amount contributed. We propose a fully refundable tax credit called the Community Contribution Credit for 90 of the value of a contribution up to 500.

Donations are deductible if the organization you give to is a 501c3 tax-exempt charity.

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Are Gofundme Donations Tax Deductible We Explain

Inside The Political Donation History Of Wealthy Sports Owners Fivethirtyeight

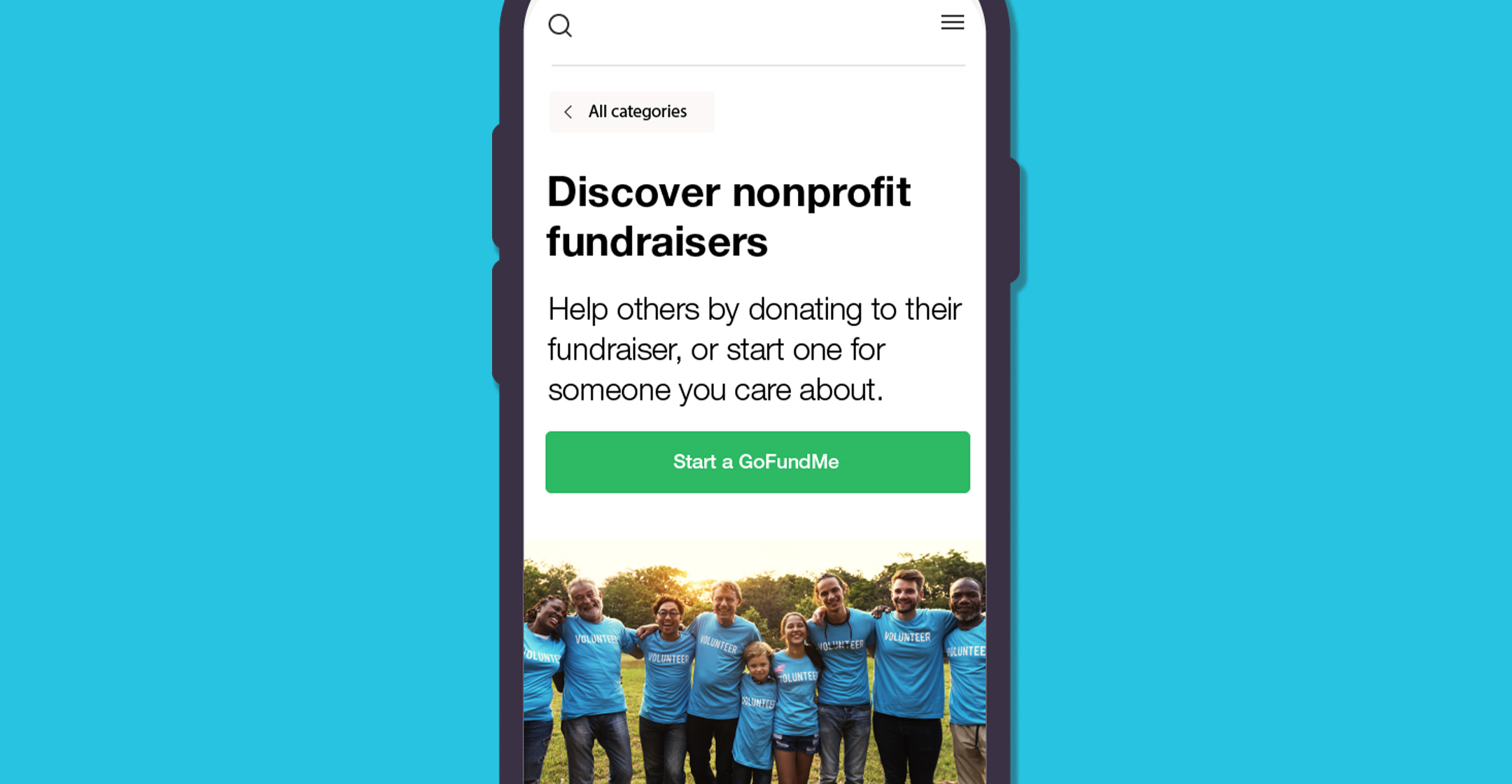

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Are Political Contributions Tax Deductible H R Block

Charitable Deductions On Your Tax Return Cash And Gifts

How Much Should You Donate To Charity District Capital

Amyotrophic Lateral Sclerosis Als Fabric Printing On Fabric Amyotrophic Lateral Sclerosis Custom Fabric

Bruce Springsteen Fighting For The Promised Land Political And Social Implications In Springsteen S Words And Actions Grin

Free Political Campaign Donation Receipt Word Pdf Eforms

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Pin By Legalizeferrets Org On Five Dollar Ferret Fridays Happy Pills Ferret Pills

Are Political Contributions Tax Deductible H R Block

States With Tax Credits For Political Campaign Contributions Money

/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)